Reporting on PR can feel like an exercise in wrestling clouds and herding cats. Whilst it’s pretty easy to understand what’s been done as far as outputs are concerned, it can be much harder to get a clear idea on what that’s got to do with the pesky business of creating commercial impact.

Excess share of voice (ESOV) can play an important role here, not only in defining how you’re doing against the competition but also proving how your activity is contributing to business growth. Whilst PR has other important benefits in terms of how you interact with your audience, we find that using ESOV offers a really important way to get a more meaningful handle on its impact from a marketing perspective.

So why ESOV? Marketing effectiveness mavens Robert Brittain and Peter Field observed that the impact of marketing on audience mental availability is driven by three factors: budget, media channel and creative strength. While it can’t express how you’re performing on creative strength, using share of voice (SOV) – how your coverage stacks up against competitors – is a great way to understand the efficacy of the other two factors.

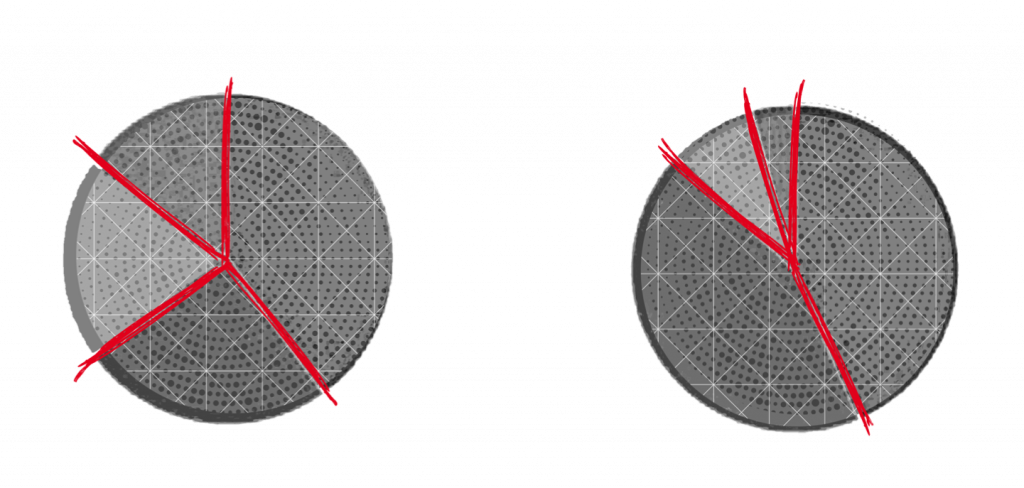

But that only tells part of the story. Whilst it allows you to broadly map how your activity is working against competitors, SOV in itself doesn’t reflect how this relates to the market share of the companies monitored. For example, a brand may have 10% greater SOV than its nearest competitor, but if its market share is 50% higher – and by implication it has a bigger marketing budget too – then a 10% lead isn’t anything to shout about.

Using ESOV – how a brand’s SOV relates to its market share – provides a more equitable metric. That’s demonstrated by the graphs featured here, showing how brand B’s apparently modest SOV is actually a significant overperformance when market share is factored in. Conversely, the seemingly solid performance of brand D is in fact much less significant when considering its healthy market share.

ESOV = SOV – SOM

What’s more, further work by Brittain, Field and others has shown that positive ESOV (that is to say SOV greater than market share) to be a reliable indicator of growth in market share. So, ESOV isn’t only a useful tool for understanding how you’re performing against the competition – increasing positive ESOV is also one of marketing’s most powerful longer term tools for helping to drive commercial success.

So what’s the best way to track ESOV?

It’s important to mention that Brittain and Field were talking about ESOV in a broader sense than PR alone – that’s to say measuring the efficacy of marketing across all channels and tactics, not just earned coverage. They also cautioned that the varied, fragmented nature of media channels can make achieving this difficult.

So whilst it’s desirable to take a holistic view, the pragmatic thing is often to pick up the channels you’re able to monitor without blowing the budget. The targeted nature of much B2B marketing gives us an advantage in this, because a high proportion of earned and paid media in a given campaign is likely to be with a relatively small coterie of publications, websites and influencers.

PR can be a smart place to start given the relative ease with which clippings can be gathered both for your brand and competitors. Groundwork will be needed in getting the data right to accurately report ESOV, but that investment time is worth it to build a clearer picture of marketing performance – and strengthen your hand in communicating its worth to the wider business.